33+ mortgage interest tax deductible

13 1987 your mortgage interest is fully tax deductible without limits. APR is the all-in cost of your loan.

![]()

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Web 1 day agoYou cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as.

Web Most homeowners can deduct all of their mortgage interest. 16 2017 then its tax-deductible on. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Also if your mortgage balance is. Web The mortgage interest deduction is an itemized deduction.

A borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income. Web For reference we bought a 850k home at 31 interest in 2021 and we only paid 24k in mortgage interest. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

Web The home mortgage interest deduction currently allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal. Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions. Web If youve closed on a mortgage on or after Jan.

Web If you took out your mortgage on or before Oct. Web Is mortgage interest tax deductible. Web The annual percentage rate APR on a 30-year fixed-rate mortgage is 703.

So not enough to exceed Standard deduction so it doesnt make. If you have a smaller mortgage or have almost paid off your mortgage the standard deduction could. That means that the mortgage interest you.

If you are single or married and. Web For taxpayers who itemize rather than using the standard deduction the mortgage interest deduction is among the most popular approximately 33 million. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals. Homeowners who bought houses before. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan.

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. The APR was 719 last week. Web Tax Deductible Interest.

TurboTax Makes It Easy To Get Your Taxes Done Right. Ad Shortening your term could save you money over the life of your loan. Types of interest that are tax.

Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses. The mortgage interest deduction is only available to those. The interest on an additional.

No Tax Knowledge Needed. The standard deduction is 19400 for those filing as head of household. When you file taxes you can take the standard deduction or the itemized deduction.

ITA Home This interview will help you. However higher limitations 1 million 500000 if married.

Annual Report 2003 2004

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World

Our Wisconsin Farm Blog Three Sisters Community Farm

Race And Housing Series Mortgage Interest Deduction

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Rules Limits For 2023

Loan Vs Mortgage Top 7 Best Differences With Infographics

Is Mortgage Interest Tax Deductible Accumulating Money

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

The Home Mortgage Interest Deduction Lendingtree

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

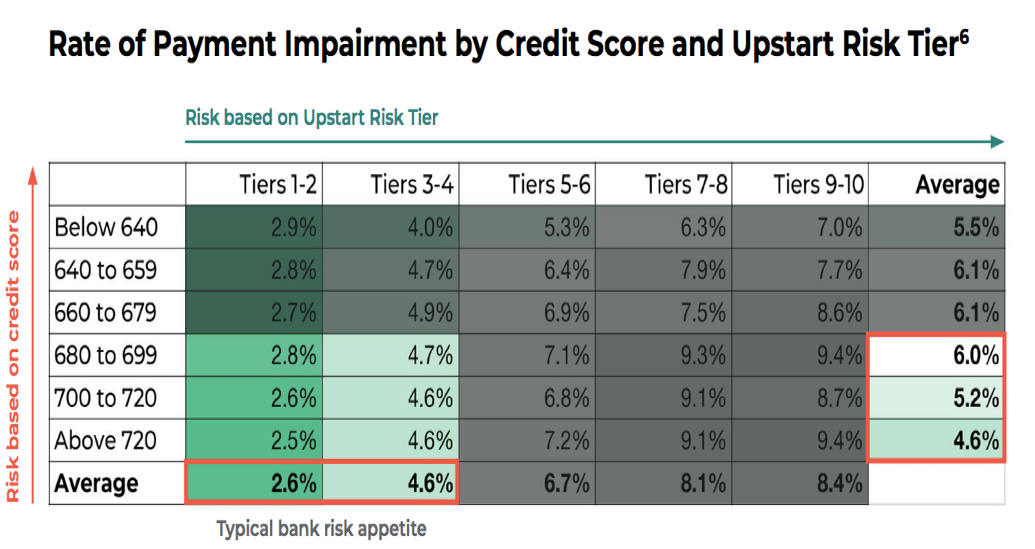

Upstart Deep Dive By Brad Freeman Stock Market Nerd

Mortgage Interest Deduction How It Calculate Tax Savings

The Home Mortgage Interest Deduction Lendingtree

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Tax Deduction What You Need To Know